direct tax in malaysia

Weve combined sophisticated automated aggregation technologies with direct editorial input from knowledgeable human editors to present the one indispensable narrative of an industry in. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə.

Solved Required Discuss In Detail All The Various Types Of Chegg Com

ASCII characters only characters found on a standard US keyboard.

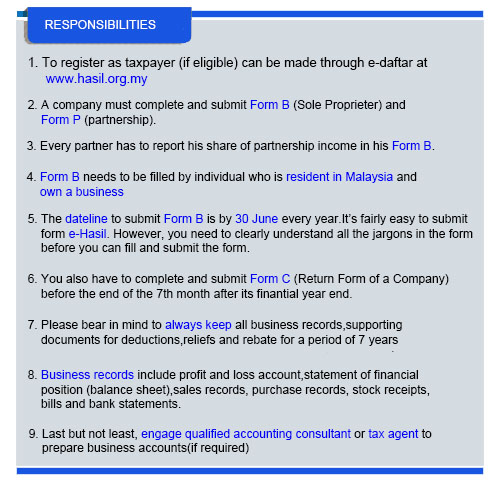

. Must contain at least 4 different symbols. It is also any activity or enterprise entered into for profit Having a business name does not separate the business entity from the owner which means that the owner of the business is responsible and liable for debts incurred by the. Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes.

Report all rental income on your tax return and deduct the associated expenses from your rental income. 2022 Tesla Model 3 in Malaysia priced from RM289k tax free PEKEMA aims to sell 500 Tesla EVs per year In Cars Local News Tesla Motors By Anthony Lim 6 December 2021 829 pm 54 comments. Foreign Direct Investment in Malaysia averaged 806143 MYR Million from 2005 until 2022 reaching an all time high of 2469041.

Get your tax refund up to 5 days early. Flight 1 From Select departure airport To Select arrival airport. Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3.

Tax Accounting. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up.

6 to 30 characters long. Plus it generates payment records simplifies reconciliation and reduces. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

Fastest refund possible. It will also send you a notice of its action along with the remaining 500 that was due to you as a tax refund. Heres an example.

This tax rebate is why most Malaysia n fresh. Fastest tax refund with e-file and direct deposit. You will be granted a rebate of RM400.

The complete texts of the following tax treaty documents are available in Adobe PDF format. Income from direct use letting or use in any other form of immovable property shall be covered by the agreement. If you own rental real estate you should be aware of your federal tax responsibilities.

TOP will deduct 1000 from your tax refund and send it to the correct government agency. Sales and Service Tax Malaysia Airlines Berhad Reg. Chartered Tax Institute of Malaysia Registration Number.

READ IN NEW TAB Malaysia Tax Guide. Tax refund time frames will vary. Direct Taxes Code 2010 Bill No.

This tax is levied on closely held corporations where earnings are retained with an intent to avoid higher individual tax rates. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. Mediagazer simplifies this task by organizing the key coverage in one place.

The IRS issues more than 9 out of 10 refunds in less than 21 days. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards. Tax rebate for Self.

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. 110 of 2010 Direct Taxes Code 2013. It can also allow immediate and direct crediting into your account by banks.

Enjoy a Bonus Side Trip to West Malaysia Bangkok or Singapore where the flight is on us you just pay the taxes. Budget and Bills Finance Acts. This amount is used for maintaining the social security of the nation.

Fastest refund possible. Personal Holding Company Tax. The loan is secured on the borrowers property through a process.

199101015438 225750-T B-13-2 Megan Avenue 2 No12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Tel. Get your tax refund up to 5 days early. Other Direct Tax Rules.

The outdated inheritance tax rules costing families 137330. WTOP delivers the latest news traffic and weather information to the Washington DC. The IRS issues more than 9 out of 10 refunds in less than 21 days.

The term immovable property shall comprise of properties as defined by the law of the contracting state in which the property is located. See todays top stories. All payments are concluded online on a real-time basis making the service as good as cash.

You were going to receive a 1500 federal tax refund. Malaysias foreign direct investment dropped to MYR 173 billion in Q2 of 2022 from MYR 244 billion in Q1 amid the impact of both COVID-19 disruptions and the war in Ukraine while still marking the seventh straight quarter of net inflow. Fastest tax refund with e-file and direct deposit.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up. 10-year mortgage deals become cheapest on the market. But you are delinquent on a student loan and have 1000 outstanding.

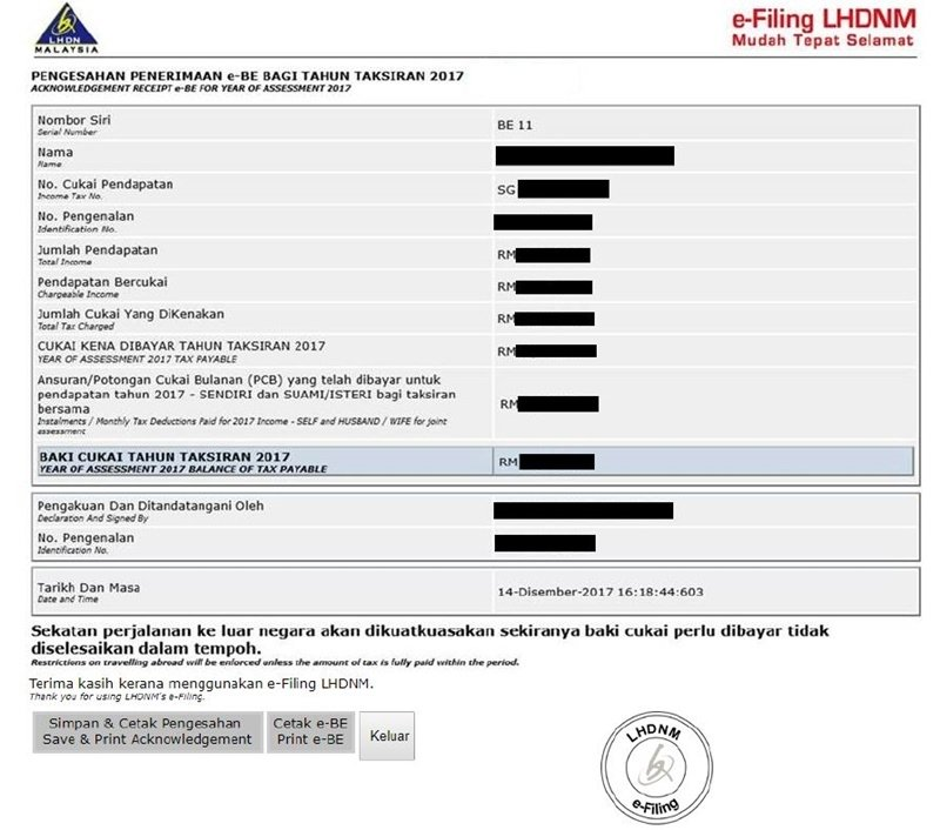

The Malaysia tax payable in respect of income derived from Malaysia shall be allowed. Savings rates hit 10-year high as new 455pc bond launches. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Tax refund time frames will vary. This tax is leviable on salaried individuals as well as self-employed taxpayers.

Business is the practice of making ones living or making money by producing or buying and selling products such as goods and services. 603-9212 7848 Email.

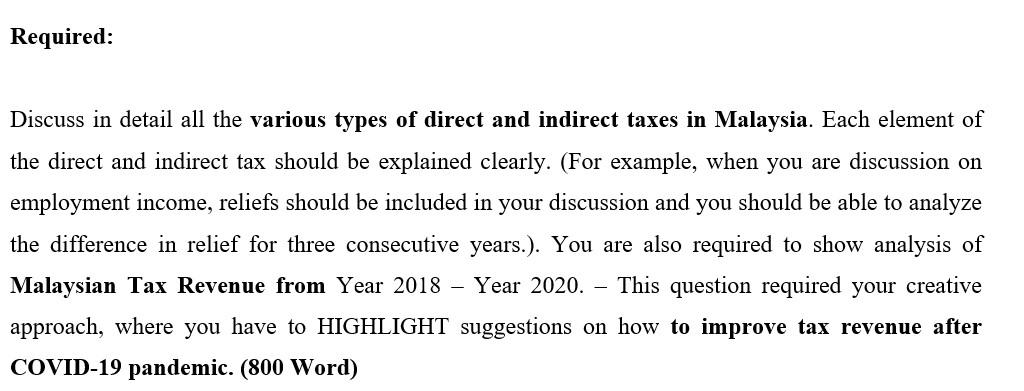

Summary Of The Budget 2021 Icdm

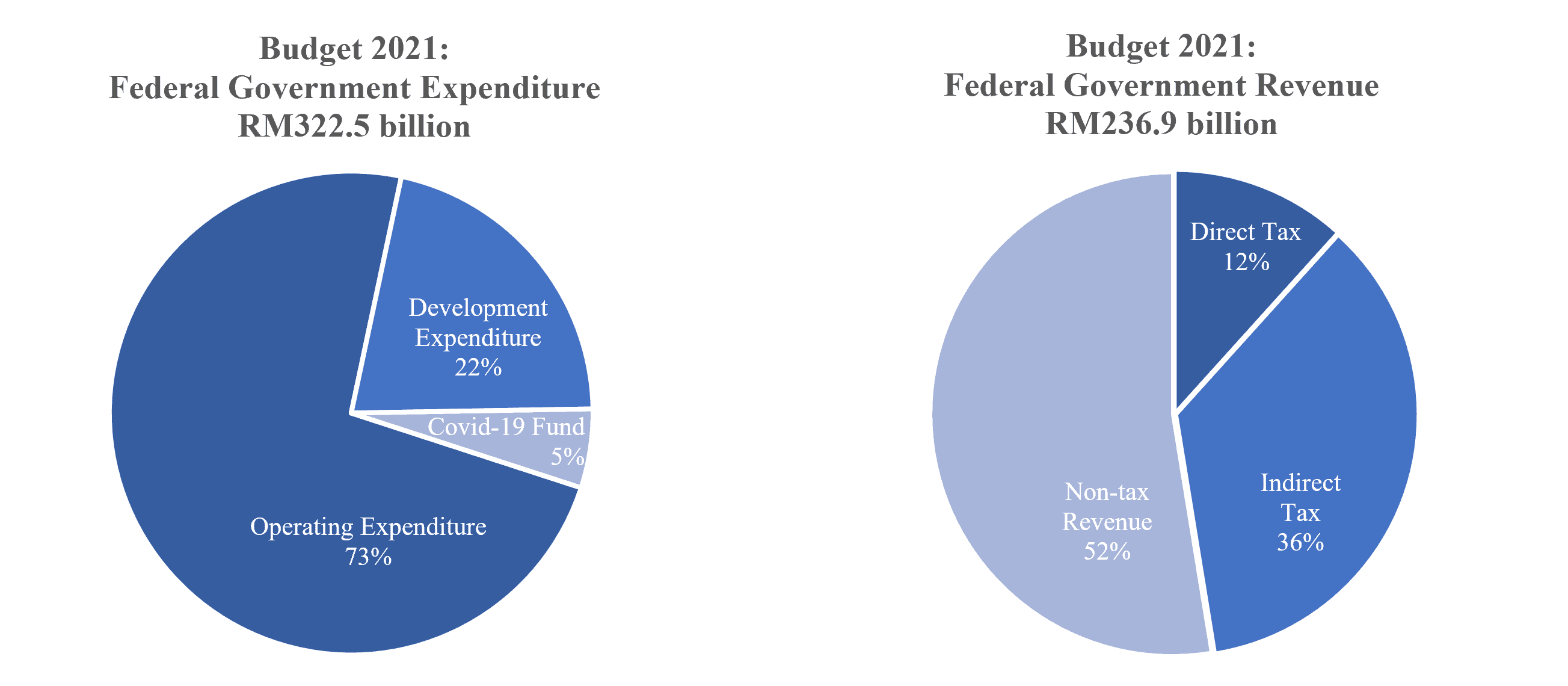

Another Brick In The Wall As Though They Are A Major Tax Contributor Up Dated

The Components Of The Government Revenue In Malaysia Download Table

Najib S Taxing Problem The Politics Of Malaysia S Gst New Mandala

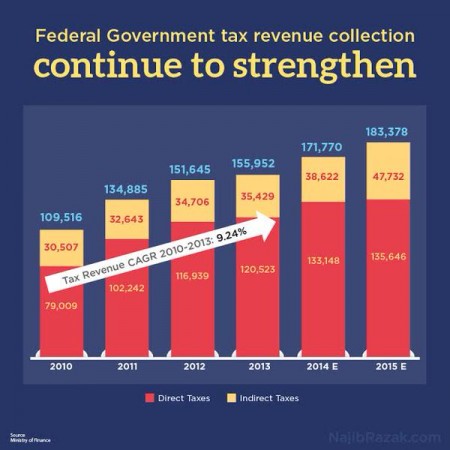

Malaysia S Digital Tax A Smart Move The Asean Post

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Malaysia Achieves Record Direct Tax Collection Of Rm137b In 2018 The Edge Markets

Understanding Tax Smeinfo Portal

Impacts Of The Self Assessment System For Corporate Taxpayers

Global Minimum Tax An Easy Fix Kpmg Global

Malaysia Tackles Taxpayer Non Compliance More Vigorously No Hidden Agenda Irb The Edge Markets

Malaysia Personal Income Tax Guide 2020 Ya 2019

Pdf The Effect Of Tax Knowledge Compliance Costs Complexity And Morale Towards Tax Compliance Among Self Employed In Malaysia Semantic Scholar

Denmark Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Malaysia Personal Income Tax Guide 2020 Ya 2019

St Partners Plt Chartered Accountants Malaysia Malaysia Source Of Funds How Important The Direct Tax And Indirect Tax To Government Total Taxes Contributed More Than 50 Of Total Funds Facebook

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Bright Simons On Twitter The Way Ghanaian Politicians Talk About Widening The Tax Net You D Think The Country Was 1 Of The Least Taxed On Earth Yet It Compares Very Well With

0 Response to "direct tax in malaysia"

Post a Comment